American Lookout Headlines receives compensation from affiliate partners for links on the site. Here's our complete list of Affiliate sites.

First Column 1

- Experts: Supreme Court Likely To Send Trump Immunity Case Back To District Court [Epoch]...

- "Historic Mistake"...

- Trump Reacts To Bill Barr Endorsement...

- ..."MAGA2024!"

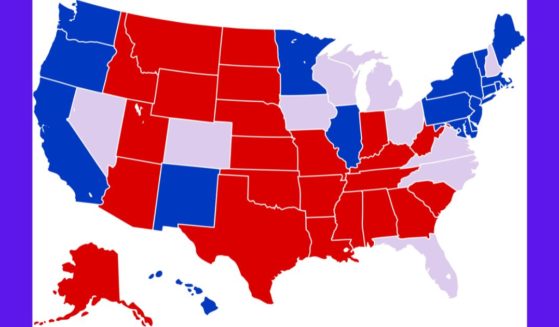

- Trump Says He Will ‘Make A Play’ To Win New York In 2024 While He’s On Trial [Epoch]...

- ...“We Love Trump” Chants Breakout As President Trump Visits Construction Site

- Jonathan Turley Explains Why Alvin Bragg Is Trump’s BEST Lawyer...

- Trump Shocks Fani Willis With Bold Legal Move...

- ...Legal Expert Rips Apart DA Alvin Bragg’s Charges Against Trump

- Judge Cannon’s Next Move Could Crush Jack Smith: ‘She Knows This Is Dirty’...

NR Only Headline

Advertisement

First Column 2

- Tucker Carlson’s ‘Chilling’ Final Monologue With Fox News Has Been Released For The First Time...

- Biden’s Decarbonization Plan Effectively Bans Gas Stoves And Appliances In Federal Buildings [Epoch]...

- Florida AG Leads Coalition Of 25 States Suing Biden Admin Over Emissions Rule [Epoch]...

- Thousands DENIED Access To Bank Withdrawals In Australia...

If you like American Lookout Headlines, please bookmark us in your browser.

First Column 3

- Melania Headlines GOP Fundraising Event...

- Key Conservative Group Spent $50.6 Million on Nikki Haley’s Failed Presidential Bid [Epoch]...

- New York Construction Worker Has Blunt Two-Word Message For Joe Biden...

- ...NYC Construction Workers and Union Members Go Wild When Trump Makes Unexpected Visit En Route to Courthouse

- These 5 Black New Yorkers Voted For Biden In 2020. Here’s Why They’re Not In 2024 [Epoch]...

- Billionaire Hedge Fund Manager Says He Is Open To Voting For Trump...

First Column 4

First Column 5

First Column 6

- Joy Reid Says She Carries Around A Copy Of Trump’s Indictments Like A ‘Pretend Bible’...

- Taylor Swift and Bill Clinton Drama Explodes After Viral Post from Monica Lewinsky...

- Hollywood Is Reportedly In Rough Shape And In The Midst Of Massive Change: 'Money Is So Tight'...

- Florida Defies Biden, Refuses To Comply With Revamped Title IX...

"

Websites

- Gateway Pundit

- WLT Report

- The Epoch Times

- Conservative Brief

- Vigilant News

- 100 Percent Fed Up

- Trending Politics

- Big League Politics

- Freedom First Network

- New York Sun

- New York Post

- Right Side Broadcasting

- Conservative Treehouse

- People's Pundit Daily

- Zero Hedge

- Patriots.win

- Lucianne

- One America News Network

- Legal Insurrection

- Wayne Dupree

- Free Republic

- Intellectual Froglegs

- Western Journal

- Steve Bannon's War Room

Second Column 1

- Trump’s Request For New Trial Denied In E. Jean Carroll Case [Epoch]...

- Trump Lawyer Humiliates Ketanji Brown Jackson During Immunity Arguments At SCOTUS...

- Judge Cannon’s Order Unsealing Evidence Reveals WH Lawyer’s Shocking Conspiracy With NARA...

- Supreme Court to Hear Trump’s Presidential Immunity Appeal [Epoch]...

- ...Seems Open to Allowing Some Presidential Immunity, May Delay Trump Trial [Epoch]

- Supreme Court Justice Clarence Thomas Discusses Operation Mongoose in Presidential Immunity Arguments...

Second Column 2

Second Column 3

Get the American Lookout Headlines daily newsletter

Second Column 4

Second Column 5

Second Column 6

- Indo-Pacific Spending Bill Puts $8 Billion Toward Countering Communist China [Epoch]...

- Pentagon Moving Ahead With Plans to Pull US Troops From Niger, Draw Down in Chad [Epoch]...

- Secret Document: Plans Being Made To Pave The Way For US Troops To Fight In Eastern Europe...

- Anti-Israel Agitators at UT-Austin Learn the Hard Way That Texas Does Things Differently Than Blue States...

- Israel's Military Intel Chief 1st Top Figure To Resign After Oct. 7 Disaster...

Telegram Accounts

Contact Us

Send Tips

Third Column 1

- Major Trade Union Endorses Biden [Epoch]...

- Left Wing Daily Show Mocks Joe Biden Over Cannibals Comments: ‘You’re Going To Lose The Election’...

- Kamala Harris Rolls Out ‘Economic Opportunity’ Tour To Boost Biden Polling...

- White House Says You Didn't Hear That Newest Biden Blunder...

- Pushing Biggest Tax Increase In Over 100 Years...

- ...Joe Biden LITERALLY Says The Quiet Part Out Loud

- The Biden White House Is Angry At The Liberal New York Times For Not Being Loyal Enough...

Third Column 3

- Bidenomics: Inflation Killing The American Dream - $100k No Longer Enough To Survive in These States...

- US Economic Growth Misses Expectations...

- ...Growth Slows To 1.6 Percent In 1st Quarter [Epoch]

- ...Dow Jones Drops

- Reaction to Biden's Economic Numbers: “Numbers made up”,“Someone's cooking the books”...

- Fight The IRS With First-Time Abatement...

- JPMorgan Chase CEO Dimon Fears US May Be Heading Back To 1970s’ Economic Woes...

Third Column 4

Third Column 5

Third Column 6

Third Column 7: Facebook Links

Websites

- Gateway Pundit

- WLT Report

- The Epoch Times

- Conservative Brief

- Vigilant News

- 100 Percent Fed Up

- Trending Politics

- Big League Politics

- Freedom First Network

- New York Sun

- New York Post

- Right Side Broadcasting

- Conservative Treehouse

- People's Pundit Daily

- Zero Hedge

- Patriots.win

- Lucianne

- One America News Network

- Legal Insurrection

- Wayne Dupree

- Free Republic

- Intellectual Froglegs

- Western Journal

- Steve Bannon's War Room