American Lookout Headlines receives compensation from affiliate partners for links on the site. Here's our complete list of Affiliate sites.

First Column 1

- Excused Juror Reveals Selection Process for Trump’s ‘Hush-Money’ Trial [Epoch]..

- Barr Calls Bragg's Case Against Trump An "Abomination"...

- ...Says He Will Vote for Former President

- Wall Street Journal Poll: Trump Has Nearly Doubled Support Among Black Men And Women Since 2020...

- Trump In Harlem: "USA! USA! USA!"...

- ...CNN Reporter Gets Brutal Reality Check After Wondering Why Americans Miss Trump

- Trump And Polish President Meet At Trump Tower [Epoch]...

NR Only Headline

Advertisement

First Column 2

If you like American Lookout Headlines, please bookmark us in your browser.

First Column 3

First Column 5

First Column 6

"

Websites

- Gateway Pundit

- WLT Report

- The Epoch Times

- Conservative Brief

- Vigilant News

- 100 Percent Fed Up

- Trending Politics

- Big League Politics

- Freedom First Network

- New York Sun

- New York Post

- Right Side Broadcasting

- Conservative Treehouse

- People's Pundit Daily

- Zero Hedge

- Patriots.win

- Lucianne

- One America News Network

- Legal Insurrection

- Wayne Dupree

- Free Republic

- Intellectual Froglegs

- Western Journal

- Steve Bannon's War Room

Second Column 1

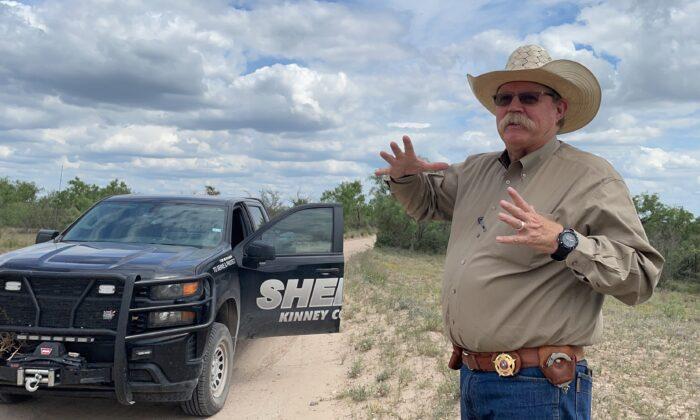

- Senate Dismisses Mayorkas Impeachment Articles...

- ...Lee Destroys Argument Against Impeaching Mayorkas

- SCOTUS Appears to Put Hundreds of Biden DOJ Jan. 6 Charges in Doubt...

- ...Supreme Court Showdown Over Jan 6 Could Effect Trump’s Cases

- Command Sergeant Major Testifies National Guard Never Called on Jan 6...

- ...Whistleblowers: Top Military Official Lied About Jan. 6 Details [Epoch]

- Comer And Raskin Have Explosive Argument Mid-Hearing, Chaos Erupts...

- Hunter Biden Appealing Gun Charge Ruling Citing Defunct ‘Immunity’ Deal [Epoch]...

- ...John Kennedy Leaves Merrick Garland Speechless With Question On Hunter Biden

Second Column 2

Second Column 3

- Rand Paul Issues Stark Warning to Trump: “He Will Lose His Voters”...

- Johnson Ouster Gains Steam, “He Should Pre-Announce His Resignation,” Says Congressman...

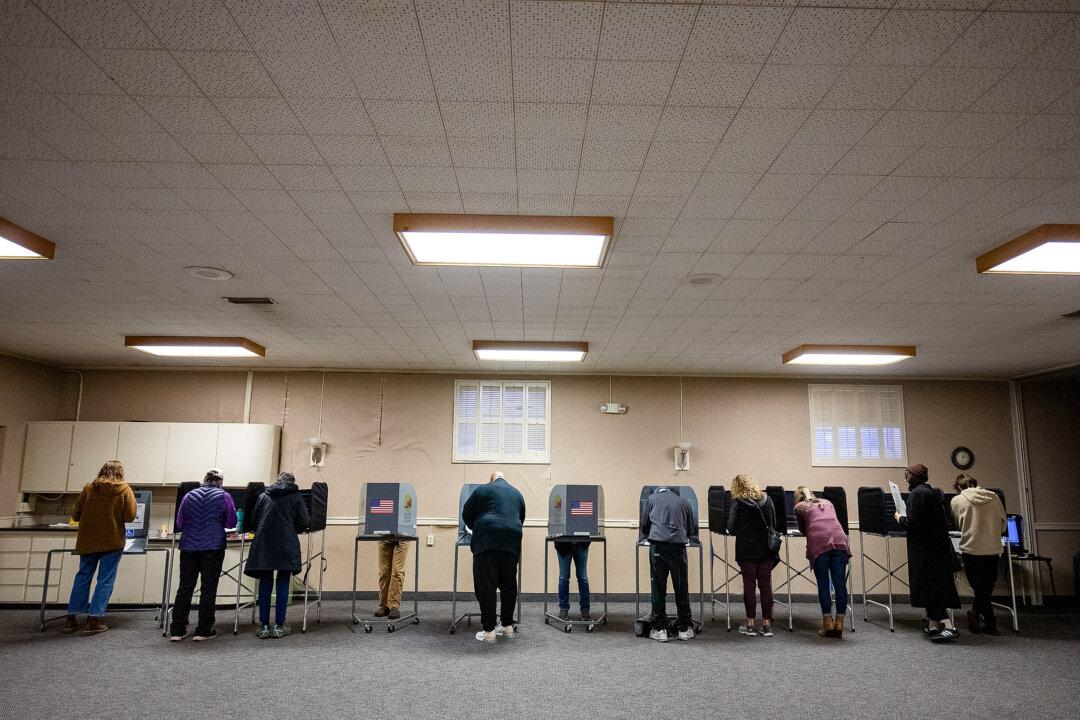

- USPS Oversight Commission Chair: ‘Subpar’ Postal Service Should Raise Concerns Over Mail-In Ballots [Epoch]...

- House Speaker Unveils Foreign Aid Bills...

MyPillow (NR)

Get the American Lookout Headlines daily newsletter

Second Column 4

Second Column 5

Second Column 6

- The UN Security Council Is About To Vote For A Palestinian State And Only A U.S. Veto Can Stop It...

- ...House Passes More Iran-Related Measures Following Its Attack on Israel [Epoch]

- Biden Admin To Announce New Iran Sanctions After Airstrike...

- Iran’s President Warns Of ‘Massive’ Response If Israel Launches Invasion [Epoch]...

- French President Macron’s Wife Sues Over Conspiracy Theory About Her Identity...

Telegram Accounts

Contact Us

Send Tips

Third Column 1

- Biden Receives Less Than Enthusiastic Reception When Visiting Pennsylvania Gas Station...

- ...Biden Dramatically Increases Oil Drilling Costs In Heartless Move

- Biden Bizarrely Claims His ‘Uncle’ Was Potentially Eaten By Cannibals...

- New Details Revealed From Biden’s Classified Documents Report...

- Biden Warns Israelis “Don’t Move on Haifa!”… Israel’s Third Largest City...

Third Column 2

Third Column 3

- Get a $40 Costco Shop Card With This Deal For New Members...

- 3 Reasons To Get An Airline Credit Card Even If You’re Not A Frequent Flyer...

- BIDENOMICS: Six Stats The Biden Regime Does Not Want You To See...

- ...The Real Danger Behind Bidenomics: Inflation

- ...Bidenomics—Inflation Persists And Jobs Decay [Epoch]

- I Didn’t Submit My Tax Return By April 15. Now What?

- ...Does Your Income Make You Upper, Middle, or Lower Class?

- This Is The Weapon That Is Being Used To Destroy America’s Middle Class...

Third Column 4

Third Column 5

Third Column 6

Third Column 7: Facebook Links

Websites

- Gateway Pundit

- WLT Report

- The Epoch Times

- Conservative Brief

- Vigilant News

- 100 Percent Fed Up

- Trending Politics

- Big League Politics

- Freedom First Network

- New York Sun

- New York Post

- Right Side Broadcasting

- Conservative Treehouse

- People's Pundit Daily

- Zero Hedge

- Patriots.win

- Lucianne

- One America News Network

- Legal Insurrection

- Wayne Dupree

- Free Republic

- Intellectual Froglegs

- Western Journal

- Steve Bannon's War Room